J.D. Power & Associates reported that sales of eight-cylinder engine vehicles maintained a 25% market share during the first quarter of this year. A good friend sent me an e-mail expressing surprise that car-buying habits have not changed despite higher gasoline prices. What's going on?

Two things. First, when it comes to buying a car, the current price of gasoline is not as important as the expected price of gasoline. If consumers believe gasoline prices won't go higher, they will consider buying gas guzzlers - especially if manufacturers offer generous incentives such as rebates or discounts. Gasoline prices held fairly steady until the latter part of the first quarter, so any effect of the recent spike in gasoline prices on automobile sales is more likely to show up this quarter.

More importantly, however, gasoline is just one component of the cost of driving. The total cost of driving includes the cost of the vehicle, the cost of insurance, the cost of maintenance and repairs, the cost of registration, the cost of parking, etc. For example, suppose you are paying $300 per month to lease a car. Insurance likely costs $100 per month or more depending on the vehicle and where you live. Let's throw in another $50 dollars a month for maintenance, repairs, and incidentals. Suppose you drive 1,000 miles every month and get 20 mpg. That means each month you buy 50 gallons of gasoline. So if gasoline costs $3 per gallon instead of $2, your incremental monthly cost is $50. In other words, your cost of driving has risen from $550 per month to $600 per month. In this example, a 50% increase in the price of gasoline results in only a 9% increase in the cost of driving. And if you drive less than 1,000 miles per month, or you get better than 20 mpg, your incremental cost is even smaller.

This is the real reason why escalating gasoline prices haven't yet had much of an impact on consumer spending. Most consumers have been able to absorb the incremental monthly expense. There is no question, however, that this can't go on forever. Eventually, higher gasoline prices will affect consumer spending and the overall economy. We don't yet seem to have reached that breaking point, but there is no question we are getting closer to it.

This site contains Vahan Janjigian's thoughts about investing and the economy.

Tuesday, April 25, 2006

Wednesday, April 19, 2006

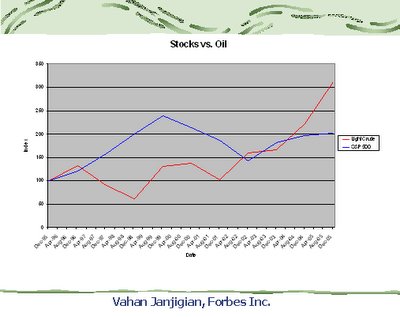

Stocks and Oil are not Correlated

Crude oil is selling for more than $72 per barrel and the average retail price of gasoline is almost $3 per gallon. Gold is almost $650 per ounce. Interest rates are rising with the 10-year Treasury note yielding more than 5%. Yet stocks keep rallying. The Dow is up 5.2% year-to-date. The Nasdaq Composite is up 7.5%.

Not too long ago, conventional wisdom said there was an inverse relationship between stock prices and oil prices. In fact, CNBC commentators often said things like, "Stocks gave up ground today as oil prices surged." Or, "Stocks rallied because oil receded."

The fact is that except for relatively short periods, there has never been a negative correlation between stocks and oil. In fact, stock prices and oil prices often move in the same direction. As shown in the graph, for the 10 years ending Dec. 2005, the S&P 500 doubled even though oil prices tripled. Yet for the full period, this positive correlation is not statistically significant.

The S&P 500 is up 4.9% since the start of the year even though light crude is up 20% during the same time. The positive correlation we've seen so far this year is unlikely to last. As energy prices go higher, I become more cautious on stocks. While I'm thrilled that stocks have done so well thus far, I'm afraid we're setting ourselves up for a big selloff as soon as some key companies report disappointing first quarter earnings results.

Thursday, April 13, 2006

With Gas Prices Rising, It's "Smart" to Raise Cash

Rising energy prices and interest rates pose a significant risk to economic growth. Crude oil is now close to $70 per barrel, and the futures price of gasoline is well above $2.00 per gallon. According to the AAA, as of today, the average retail price of unleaded gasoline is $2.72. Where I live in New York, it's more like $2.90.

I've been warning for quite some time in the Forbes Growth Investor that the economy can't continue to thrive indefinitely if high energy prices persist. Now that gasoline prices are on the rise, I'm even more concerned. Furthermore, we just saw the yield on the 10-year Treasury note rise above 5%. This double whammy of high energy prices and rising interest rates leads me to recommend a more conservative asset allocation. Investors should decrease their exposure to stocks and hold more cash and short-term notes. At a time when many market prognosticators are saying equities will provide only single-digit returns, what's wrong with holding cash? The fed funds rate is likely to go to 5% in May. Cash will give you a reasonable return with no risk.

Please note that I am not recommending that you get out of stocks completely. I'm simply saying that it makes sense to reduce your exposure. Of course, the actual allocation for an individual would depend upon his/her objectives and constraints. Nonetheless, I think at this time, most investors would be well advised to have no more than 50% of their portfolio in stocks.

As mentioned above, gasoline prices are on the rise. Yet DaimlerChrysler is facing tremendous pressure to shut down its Smart car unit. Many Americans aren't familiar with these small two-passenger vehicles, but they are quite popular in Europe. Daimler has been considering offering them for sale in the U.S. The cars are extremely fuel efficient and suprisingly safe. But the company has been losing money on them. With energy prices unlikely to fall back to the levels we were used to just a couple of years ago, consumer interest in fuel efficient cars will grow. It seems like a bad time to get out of the small-car business. If Daimler ever makes the Smart car available for sale in the U.S., I will be among the first in line to buy one.

Monday, April 10, 2006

SEC's Mutual Fund Independence Rule Must Go

A couple of years ago, when William Donaldson was still Chairman of the SEC, he pushed through a rule mandating that 75% of a mutual fund's board of directors, including the chair, be independent. At the time, I said this was a bad idea. It seems the courts agree. Just before Mr. Donaldson ended his tenure at the SEC, a federal appeals court said the SEC had rushed the rule through and must review it. But Mr. Donaldson decided to push it through again and quickly before stepping down. Once again, the court has sent it back for further review. Under new SEC Chairman Christopher Cox, we may finally see some common sense return to this matter. Here are my comments on this issue as published in the March 2004 issue of the Forbes Growth Investor.

Scrutiny of the mutual fund industry continues.The SEC has issued a number of proposals. One that caught my attention would require that at least 75% of a fund’s board of directors be independent.This seems like an excessively high figure. For example, it would mean that a board with 10 members could have at most two individuals who are affiliated with the management of the fund. Personally, I would feel more than a little anxious investing my money in a mutual fund with this kind of structure. I’d prefer knowing that there is a critical mass of individuals on the board who really understand the business. Despite its proposal, the SEC must be a little worried that independent directors may not be completely up to snuff. Maybe that’s why the proposal would also require funds to "explicitly authorize the independent directors to hire employees and others to help the independent directors fulfill their fiduciary duties." This sounds like a call for the creation of a whole new industry. Maybe it’s part of a grand jobs creation plan. But who will pay for all these new employees to advise the independent directors? The investors of course. If you ask me, this is all the more reason to avoid funds and buy individual stocks instead.

Scrutiny of the mutual fund industry continues.The SEC has issued a number of proposals. One that caught my attention would require that at least 75% of a fund’s board of directors be independent.This seems like an excessively high figure. For example, it would mean that a board with 10 members could have at most two individuals who are affiliated with the management of the fund. Personally, I would feel more than a little anxious investing my money in a mutual fund with this kind of structure. I’d prefer knowing that there is a critical mass of individuals on the board who really understand the business. Despite its proposal, the SEC must be a little worried that independent directors may not be completely up to snuff. Maybe that’s why the proposal would also require funds to "explicitly authorize the independent directors to hire employees and others to help the independent directors fulfill their fiduciary duties." This sounds like a call for the creation of a whole new industry. Maybe it’s part of a grand jobs creation plan. But who will pay for all these new employees to advise the independent directors? The investors of course. If you ask me, this is all the more reason to avoid funds and buy individual stocks instead.

Thursday, April 06, 2006

Coke's Director Compensation Plan

Coca-Cola announced changes in the way it will compensate members of its board of directors. Directors will no longer receive outright grants of cash and stock. Instead, each year they will get stock units initially worth $175,000. But they can't cash them in for three years. Even then, they won't be worth anything unless the company achieves certain goals. In particular, per share operating earnings must rise by at least a target amount. Currently, that target is set at an annual rate of 8%.

At least one component of this plan is flawed. Awarding directors when earnings are growing is a good idea, but using per share earnings is wrong. This figure can easily be manipulated simply through share repurchases. Under the new plan, directors have a strong incentive to keep dividend payments to a minimum and return cash to shareholders through buybacks instead. From the shareholders' point of view, there is little difference between dividends and share repurchases. But from the directors' point of view, there could be a world of difference. Coke's plan would be much better if directors' compensation was tied to the growth in operating earnings rather than the growth in operating earnings per share.

Executive compensation is very hot issue right now. Some studies show that executive compensation is now about 400 times that of the average employee's salary. About twenty-five years ago, the multiple was closer to 20. With CEO compensation in particular going to the stratosphere, shareholders wonder if things have gone out of hand. I'll ask compensation expert Jim Reda of James F. Reda & Assoc. this question and more. This MoneyMasters interview will be posted on Forbes.com on Thursday, May 4.

At least one component of this plan is flawed. Awarding directors when earnings are growing is a good idea, but using per share earnings is wrong. This figure can easily be manipulated simply through share repurchases. Under the new plan, directors have a strong incentive to keep dividend payments to a minimum and return cash to shareholders through buybacks instead. From the shareholders' point of view, there is little difference between dividends and share repurchases. But from the directors' point of view, there could be a world of difference. Coke's plan would be much better if directors' compensation was tied to the growth in operating earnings rather than the growth in operating earnings per share.

Executive compensation is very hot issue right now. Some studies show that executive compensation is now about 400 times that of the average employee's salary. About twenty-five years ago, the multiple was closer to 20. With CEO compensation in particular going to the stratosphere, shareholders wonder if things have gone out of hand. I'll ask compensation expert Jim Reda of James F. Reda & Assoc. this question and more. This MoneyMasters interview will be posted on Forbes.com on Thursday, May 4.

Subscribe to:

Comments (Atom)