Crude oil is selling for more than $72 per barrel and the average retail price of gasoline is almost $3 per gallon. Gold is almost $650 per ounce. Interest rates are rising with the 10-year Treasury note yielding more than 5%. Yet stocks keep rallying. The Dow is up 5.2% year-to-date. The Nasdaq Composite is up 7.5%.

Not too long ago, conventional wisdom said there was an inverse relationship between stock prices and oil prices. In fact, CNBC commentators often said things like, "Stocks gave up ground today as oil prices surged." Or, "Stocks rallied because oil receded."

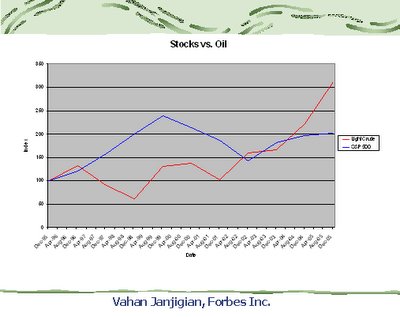

The fact is that except for relatively short periods, there has never been a negative correlation between stocks and oil. In fact, stock prices and oil prices often move in the same direction. As shown in the graph, for the 10 years ending Dec. 2005, the S&P 500 doubled even though oil prices tripled. Yet for the full period, this positive correlation is not statistically significant.

The S&P 500 is up 4.9% since the start of the year even though light crude is up 20% during the same time. The positive correlation we've seen so far this year is unlikely to last. As energy prices go higher, I become more cautious on stocks. While I'm thrilled that stocks have done so well thus far, I'm afraid we're setting ourselves up for a big selloff as soon as some key companies report disappointing first quarter earnings results.