I was asked several times this past week about the presidential candidates and their plans to revive the economy. How the candidates would get us out of recession is largely irrelevant. After all, whoever wins the election will not actually enter the White House until a year from now. Hopefully, the recession will be over by then.

I know that not everyone believes we are actually in a recession, but whether we are or aren't is also largely irrelevant. The fact is that economic growth has slowed tremendously and some regions of the country are experiencing contraction. In any case, the situation is dire enough that something must be done to revive the economy.

I explained on MSNBC and on the Leon Charney Report, which airs in the New York City area, that an economic recession is a bit like a patient who is having a heart attack. First the doctor treats the heart attack--usually with surgery and medication--then once the patient has been stabilized, the doctor addresses the long-term health issues. He might prescribe a change in diet and an exercise program. The goal is to make the patient healthier in order to reduce the odds that he will suffer another heart attack in the future.

From what I've been hearing so far, the Democrats' proposals address the heart attack. They are looking for ways to immediately revive the economy. But they are ignoring the long-term health issues. I'm not seeing anything on their table that would keep the economy healthy over the long term and reduce the odds of another recession.

The Republican candidates, on the other hand, are focused on the long term. They all want to reduce tax rates on individuals and corporations. Mike Huckabee is even proposing to eliminate the income tax entirely and replace it with a national sales tax. Lower taxes will certainly go a long way to ensure the long-term health of the economy, but they don't do much to address the immediate problem.

Yesterday, government officials announced agreement on a $150 billion economic stimulus package. They plan to mail checks to about 117 million families. They even proposed allowing Fannie Mae and Freddie Mac to temporarily purchase mortgages well above the current $417,000 limit. These proposals are well and good, but they merely treat the heart attack. They don't do anything to ensure the economy's long-term health. Hopefully, the Senate will add such measures before a final bill reaches the president's desk.

This site contains Vahan Janjigian's thoughts about investing and the economy.

Friday, January 25, 2008

Monday, January 21, 2008

Too Late to Turn Bearish

It's funny how stock market bulls often turn bearish after prices have already fallen. I've been a bear for quite a while and found myself debating a number of bulls over the past year. One well-known bull even argued that by giving bears like me an equal amount of air time, the media was falsely creating the impression that economists were split on the issue of future growth.

Today there are no serious economists left who are predicting strong growth. The most bullish among them, including Fed Chairman Ben Bernanke, are predicting only weak growth. Many believe a recession is quite likely. Some, like myself, believe a recession has already arrived. Even non-farm payroll growth, perhaps the most encouraging economic measure all along, is starting to show serious signs of strain.

Today I had an interesting conversation with Professor Michael Goldstein of Babson College. He and I worked together over a decade ago when we were both on the faculty at Boston College. Michael was preparing for a television interview about the stock market. He reminded me that a year ago both of us were scratching our heads trying to understand why stocks were rising so rapidly. At that time, we were both concerned about falling house prices and their detrimental effects on consumer spending. Today we are just as concerned about rising credit card defaults.

Dow futures are currently indicating a very weak opening tomorrow morning. The Dow may immediately plunge 500 points or more. Michael and I think it could even dip below 11,000 soon--at least on an intra-day basis. However, we also agreed that significant declines below that level are unlikely.

Most long-term investors should take a contrarian view. At this time, they should be thinking more about buying than selling. It isn't yet time to jump in with both feet, but it is time to start thinking about taking advantage of serious dips. Some Special Situation stocks we continue to favor include SVU, RKT, and PERY. These also are stocks that I personally have been buying.

Today there are no serious economists left who are predicting strong growth. The most bullish among them, including Fed Chairman Ben Bernanke, are predicting only weak growth. Many believe a recession is quite likely. Some, like myself, believe a recession has already arrived. Even non-farm payroll growth, perhaps the most encouraging economic measure all along, is starting to show serious signs of strain.

Today I had an interesting conversation with Professor Michael Goldstein of Babson College. He and I worked together over a decade ago when we were both on the faculty at Boston College. Michael was preparing for a television interview about the stock market. He reminded me that a year ago both of us were scratching our heads trying to understand why stocks were rising so rapidly. At that time, we were both concerned about falling house prices and their detrimental effects on consumer spending. Today we are just as concerned about rising credit card defaults.

Dow futures are currently indicating a very weak opening tomorrow morning. The Dow may immediately plunge 500 points or more. Michael and I think it could even dip below 11,000 soon--at least on an intra-day basis. However, we also agreed that significant declines below that level are unlikely.

Most long-term investors should take a contrarian view. At this time, they should be thinking more about buying than selling. It isn't yet time to jump in with both feet, but it is time to start thinking about taking advantage of serious dips. Some Special Situation stocks we continue to favor include SVU, RKT, and PERY. These also are stocks that I personally have been buying.

Thursday, January 17, 2008

Bernanke Deserves Blame for Sell-Off in Stocks

Ben Bernanke testified in Congress today. Investors reacted by dumping stocks. Some insist that the sell-off had little to do with his remarks and more to do with other factors, such as Merrill Lynch's disappointing results. I doubt this is the case. After all, Merrill Lynch announced its results early this morning and the market was holding up well--at least until Bernanke's testimony got under way.

The Chairman's remarks made it clear that he is very worried about the economy. Although he said the Fed is still not forecasting recession, he clearly indicated that growth will be disappointing. He mentioned the troubled banks, mortgage-related problems in the residential market, signs of weakness extending into the commercial market, weakening employment figures, and an uptick in core inflation.

Bernanke strongly hinted that the Fed will cut interest rates once again. Some investors are disappointed that the Fed may not actually implement a cut until the Jan. 30 meeting. They want a cut right now.

Bernanke also asked Congress for fiscal stimulus. He apparently believes things are so bad that interest rate cuts alone are not enough to stimulate the economy. The mere fact that he was asking Congress for tax relief made investors nervous.

Cutting taxes is the best way to prevent recession. But Bernanke was not arguing for the kinds of tax cuts Republicans favor. Instead of cutting tax rates or making the Bush tax cuts permanent, he expressed a preference for something immediate but temporary. His comments were well-received by Democrats.

Alex Witt of MSNBC asked me about the political repercussions of all this. The bottom line is that things don't look good for the Republicans. Right or wrong, the party in power gets the credit if the economy does well. Likewise, voters blame the president and his party if a recession occurs. Voters demand change. At this point, an economic recession would improve the Democrats chances of taking the White House this fall. But with Democrats controlling both Congress and the White House, taxes are sure to go higher. Then we'll really know what a recession feels like.

The Chairman's remarks made it clear that he is very worried about the economy. Although he said the Fed is still not forecasting recession, he clearly indicated that growth will be disappointing. He mentioned the troubled banks, mortgage-related problems in the residential market, signs of weakness extending into the commercial market, weakening employment figures, and an uptick in core inflation.

Bernanke strongly hinted that the Fed will cut interest rates once again. Some investors are disappointed that the Fed may not actually implement a cut until the Jan. 30 meeting. They want a cut right now.

Bernanke also asked Congress for fiscal stimulus. He apparently believes things are so bad that interest rate cuts alone are not enough to stimulate the economy. The mere fact that he was asking Congress for tax relief made investors nervous.

Cutting taxes is the best way to prevent recession. But Bernanke was not arguing for the kinds of tax cuts Republicans favor. Instead of cutting tax rates or making the Bush tax cuts permanent, he expressed a preference for something immediate but temporary. His comments were well-received by Democrats.

Alex Witt of MSNBC asked me about the political repercussions of all this. The bottom line is that things don't look good for the Republicans. Right or wrong, the party in power gets the credit if the economy does well. Likewise, voters blame the president and his party if a recession occurs. Voters demand change. At this point, an economic recession would improve the Democrats chances of taking the White House this fall. But with Democrats controlling both Congress and the White House, taxes are sure to go higher. Then we'll really know what a recession feels like.

Wednesday, January 16, 2008

Family-Owned Businesses Fear Higher Taxes

PricewaterhouseCoopers (PwC) invited me last night to dine with the CFOs of a dozen privately owned family businesses. These companies ranged in size from about $20 million per year in revenues to $2 billion. Executives from publicly traded companies have plenty of opportunities to meet with one another, but those from privately held family businesses often do not. Last night's dinner was put together to address this situation.

Since my focus is primarily on publicly-traded equities, I welcomed the opportunity to meet executives from the other side. Although I work for a privately-held family business, I rarely get a chance to meet executives from other such companies. The evening was a wonderful learning experience. In particular, PwC had compiled an interesting survey of privately-owned family businesses. Many of the findings were surprising to me. One was not. It turns out these executives worry a great deal about government regulation and taxation. In fact, two-thirds of respondents felt that tax simplification and/or tax reduction should be a priority for government over the next three to five years.

I have written often about the tax burden in the Forbes Growth Investor and elsewhere and wondered why the stock market had been doing so well even when it became increasingly apparent that the Democrats stood a good chance of taking the White House. A Democratic president combined with a Democratic majority in Congress spells higher taxes. Even if the Republicans manage to hold onto the White House, the Bush tax cuts are likely to expire--another way to spell higher taxes. It is difficult to argue that stocks can thrive in a high-tax environment--at least not until they first sustain a sizable sell-off. Perhaps that is what we are going through right now.

Since my focus is primarily on publicly-traded equities, I welcomed the opportunity to meet executives from the other side. Although I work for a privately-held family business, I rarely get a chance to meet executives from other such companies. The evening was a wonderful learning experience. In particular, PwC had compiled an interesting survey of privately-owned family businesses. Many of the findings were surprising to me. One was not. It turns out these executives worry a great deal about government regulation and taxation. In fact, two-thirds of respondents felt that tax simplification and/or tax reduction should be a priority for government over the next three to five years.

I have written often about the tax burden in the Forbes Growth Investor and elsewhere and wondered why the stock market had been doing so well even when it became increasingly apparent that the Democrats stood a good chance of taking the White House. A Democratic president combined with a Democratic majority in Congress spells higher taxes. Even if the Republicans manage to hold onto the White House, the Bush tax cuts are likely to expire--another way to spell higher taxes. It is difficult to argue that stocks can thrive in a high-tax environment--at least not until they first sustain a sizable sell-off. Perhaps that is what we are going through right now.

Friday, January 11, 2008

By How Much Will Citi Cut the Dividend?

Citigroup is scheduled to announce fourth quarter financial results on Tuesday morning. Analysts are projecting a loss of almost a dollar per share. Investors are keen to hear how much more mortgage-related writedowns there will be. As for the dividend, they are no longer wondering if it will be cut. The only question left is by how much.

The board of directors is reportedly meeting on Monday. You can bet the dividend will be a high-priority topic of discussion. Although company officials have said a number of times that the dividend is safe, no one believes this anymore. Cutting the dividend is the surest way to preserve capital. And you can bet the new investors from Abu-Dhabi will insist upon it.

Citigroup has a long history of consistent dividend increases. Yet management knows that the company can save almost $11 billion in one year alone by eliminating the dividend entirely. It can save $1 billion simply by taking back the 10% increase implemented just one year ago. Management also knows that investors are expecting a dividend cut, so it's an easy thing for them to do. The consensus is calling for a 50% reduction. If that turns out to be the case, the stock may stage a bit of a rally. However, a cut of less than 50% should cause the stock to surge.

The board of directors is reportedly meeting on Monday. You can bet the dividend will be a high-priority topic of discussion. Although company officials have said a number of times that the dividend is safe, no one believes this anymore. Cutting the dividend is the surest way to preserve capital. And you can bet the new investors from Abu-Dhabi will insist upon it.

Citigroup has a long history of consistent dividend increases. Yet management knows that the company can save almost $11 billion in one year alone by eliminating the dividend entirely. It can save $1 billion simply by taking back the 10% increase implemented just one year ago. Management also knows that investors are expecting a dividend cut, so it's an easy thing for them to do. The consensus is calling for a 50% reduction. If that turns out to be the case, the stock may stage a bit of a rally. However, a cut of less than 50% should cause the stock to surge.

Monday, January 07, 2008

Bremmer Warns of U.S. Decline

Ian Bremmer, president of the Eurasia Group, is one of the smartest guys I know. That's why I pay close attention to what he says. And what he is saying right now is not just surprising; it is scary.

He just released a report called the Top 9 Risks of 2008. Because the Eurasia Group is a political risk advisory and consulting firm, some of the items on the list are not at all surprising. What is surprising, however, is that he now considers the United States the #1 risk on his list. Bremmer argues that America's influence is on the wane. The risk is that the country will disengage from the world, erect barriers to trade, and make immigration more difficult. In short, the U.S. is losing both the political will and capital to lead the world. Go to Eurasia Group to learn more.

He just released a report called the Top 9 Risks of 2008. Because the Eurasia Group is a political risk advisory and consulting firm, some of the items on the list are not at all surprising. What is surprising, however, is that he now considers the United States the #1 risk on his list. Bremmer argues that America's influence is on the wane. The risk is that the country will disengage from the world, erect barriers to trade, and make immigration more difficult. In short, the U.S. is losing both the political will and capital to lead the world. Go to Eurasia Group to learn more.

Friday, January 04, 2008

Oil Prices Likely to Drop as Recession Fears Grow

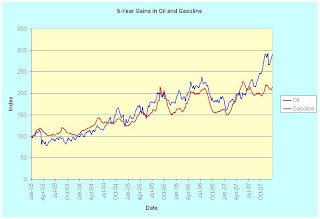

As shown in the graph above, both oil (blue line) and gasoline (red line) prices have surged over the past five years. However, oil prices have about tripled while gasoline prices have only done a little more than a double. The prices of these two commodities were tracking together quite closely until around June 2007. Since June, however, gasoline prices have remained relatively stable while oil prices have continued to rise.

Yesterday, oil broke above $100 per barrel. Speculators are getting much of the blame. The divergence between oil and gasoline prices gives some credence to this theory. After all, looking strictly at supply and demand considerations it is difficult to understand why oil prices have gone up so high. While it is certainly true that oil-producing regions of the world are not very stable, and that the world is consuming all it produces, there are no shortages.

As today's numbers show, the economy is no longer producing a sufficient number of jobs. The unemployment rate jumped to 5%. The U.S. economy is slowing and the probability of recession has risen significantly. While gasoline prices may go up in the short run, it is much more likely that an economic slowdown will cause oil prices to fall over the longer run. Look for oil to drop to $70 per barrel this year.

Thursday, January 03, 2008

Stocks Will Struggle in 2008

Following is my commentary from the January 2008 issue of the Forbes Growth Investor, which was released earlier to subscribers:

The stock market ended 2007 with a whimper. The closely followed S&P 500 Index managed to post only a 3.5% gain for the full year. Investors could have done about as well simply by holding cash and avoiding risk entirely. Although the other major indexes did somewhat better than the S&P 500 (see page 6 of newsletter for their full year returns), 2007 was a lackluster year overall.

Troubles in the housing market are largely to blame for weak stock returns. In fact, shares of home builders and financial companies were particularly hard hit during the year. As of now, prospects for stocks in 2008 do not look all that promising as the housing bubble has yet to fully deflate. According to the most recent reports, problems in housing are likely to get worse before they finally bottom. New home sales were down 34% year-over-year in November. Existing home sales were down 20%. If home sales continue at current rates, it will take more than nine months to clear the inventory of new homes on the market and more than 10 months to deplete the inventory of existing homes.

But it’s not just sales that are falling. Housing prices are collapsing as well. In October, the S&P/Case-Shiller 10-City Composite Home Price Index posted its biggest decline ever, falling 6.7% from a year ago and 1.4% from the previous month. This index is down 7.3% from its June peak. More worrisome, however, is that the rate of decline is accelerating.

All along, the more optimistic economists had been telling us not to worry. They said the sub-prime market was relatively small and its troubles would not spread to the rest of the housing market. They were wrong about this. What’s worse, it now appears that housing problems are spreading into nonhousing areas as well. Evidence is mounting that credit card delinquencies and defaults are rising. According to one study conducted by the Associated Press, outstanding balances on credit card accounts that are at least 30 days late jumped 26% from a year ago. Those that are 90 days late jumped 50%. The same study found an 18% increase in defaults. With the holiday shopping season having just ended, it’s a sure bet that these numbers will get worse.

Investors are just starting to realize that credit card problems are related to the housing and mortgage debacles. Because lending standards have been tightened, even otherwise creditworthy borrowers cannot easily tap the shrinking equity in their homes to pay off their credit card bills. And the so-called sophisticated institutional investors are less willing now than they once were to purchase securitized credit card loans.

Prospects for stocks in 2008 do not look good indeed. Housing and consumer spending are not the only things to worry about. Economic growth is slowing, yet persistently high energy prices and rising core inflation give the Fed little room to cut interest rates. Even the jobs market, which had long remained a bright spot in the economy, is starting to make investors nervous. Many economists now expect reduced growth in non-farm payrolls and an increase in the unemployment rate. The Dec. payroll figure and unemployment rate will be announced on Jan. 4. Anything out of the ordinary for either measure could create tremendous volatility for stocks.

The stock market ended 2007 with a whimper. The closely followed S&P 500 Index managed to post only a 3.5% gain for the full year. Investors could have done about as well simply by holding cash and avoiding risk entirely. Although the other major indexes did somewhat better than the S&P 500 (see page 6 of newsletter for their full year returns), 2007 was a lackluster year overall.

Troubles in the housing market are largely to blame for weak stock returns. In fact, shares of home builders and financial companies were particularly hard hit during the year. As of now, prospects for stocks in 2008 do not look all that promising as the housing bubble has yet to fully deflate. According to the most recent reports, problems in housing are likely to get worse before they finally bottom. New home sales were down 34% year-over-year in November. Existing home sales were down 20%. If home sales continue at current rates, it will take more than nine months to clear the inventory of new homes on the market and more than 10 months to deplete the inventory of existing homes.

But it’s not just sales that are falling. Housing prices are collapsing as well. In October, the S&P/Case-Shiller 10-City Composite Home Price Index posted its biggest decline ever, falling 6.7% from a year ago and 1.4% from the previous month. This index is down 7.3% from its June peak. More worrisome, however, is that the rate of decline is accelerating.

All along, the more optimistic economists had been telling us not to worry. They said the sub-prime market was relatively small and its troubles would not spread to the rest of the housing market. They were wrong about this. What’s worse, it now appears that housing problems are spreading into nonhousing areas as well. Evidence is mounting that credit card delinquencies and defaults are rising. According to one study conducted by the Associated Press, outstanding balances on credit card accounts that are at least 30 days late jumped 26% from a year ago. Those that are 90 days late jumped 50%. The same study found an 18% increase in defaults. With the holiday shopping season having just ended, it’s a sure bet that these numbers will get worse.

Investors are just starting to realize that credit card problems are related to the housing and mortgage debacles. Because lending standards have been tightened, even otherwise creditworthy borrowers cannot easily tap the shrinking equity in their homes to pay off their credit card bills. And the so-called sophisticated institutional investors are less willing now than they once were to purchase securitized credit card loans.

Prospects for stocks in 2008 do not look good indeed. Housing and consumer spending are not the only things to worry about. Economic growth is slowing, yet persistently high energy prices and rising core inflation give the Fed little room to cut interest rates. Even the jobs market, which had long remained a bright spot in the economy, is starting to make investors nervous. Many economists now expect reduced growth in non-farm payrolls and an increase in the unemployment rate. The Dec. payroll figure and unemployment rate will be announced on Jan. 4. Anything out of the ordinary for either measure could create tremendous volatility for stocks.

Subscribe to:

Comments (Atom)