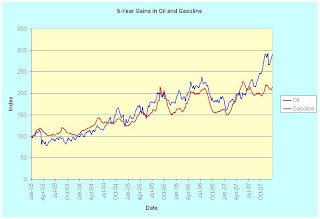

As shown in the graph above, both oil (blue line) and gasoline (red line) prices have surged over the past five years. However, oil prices have about tripled while gasoline prices have only done a little more than a double. The prices of these two commodities were tracking together quite closely until around June 2007. Since June, however, gasoline prices have remained relatively stable while oil prices have continued to rise.

Yesterday, oil broke above $100 per barrel. Speculators are getting much of the blame. The divergence between oil and gasoline prices gives some credence to this theory. After all, looking strictly at supply and demand considerations it is difficult to understand why oil prices have gone up so high. While it is certainly true that oil-producing regions of the world are not very stable, and that the world is consuming all it produces, there are no shortages.

As today's numbers show, the economy is no longer producing a sufficient number of jobs. The unemployment rate jumped to 5%. The U.S. economy is slowing and the probability of recession has risen significantly. While gasoline prices may go up in the short run, it is much more likely that an economic slowdown will cause oil prices to fall over the longer run. Look for oil to drop to $70 per barrel this year.